Economic Fault Lines Deepen, Bitcoin Could Become the Next Liquidity "Release Valve"

Original Title: The Two-Tier K-Shaped Economy

Original Author: arndxt

Original Translation: AididiaoJP, Foresight News

The U.S. economy has split into two worlds: one side sees a thriving financial market, while the other side experiences a slow decline in the real economy.

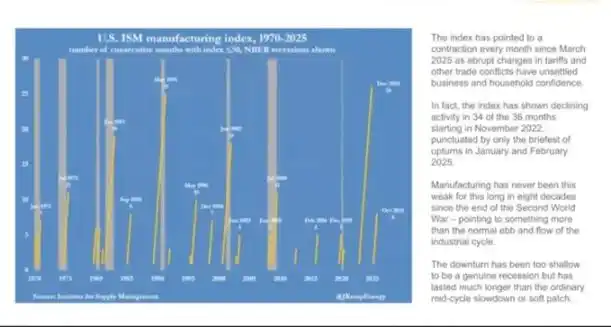

The Manufacturing PMI Index has been contracting for over 18 months, marking the longest record since World War II, yet the stock market continues to rise as profits become increasingly concentrated in tech giants and financial companies. (Note: The full name of "Manufacturing PMI Index" is "Purchasing Managers' Index for Manufacturing" and it serves as a barometer of the manufacturing sector's health.)

This is essentially an "asset price inflation."

Liquidity continues to drive up prices of similar assets, while wage growth, credit creation, and small business vitality remain stagnant.

The result is an economic divide, where in recovery or economic cycles, different sectors move in completely opposite directions:

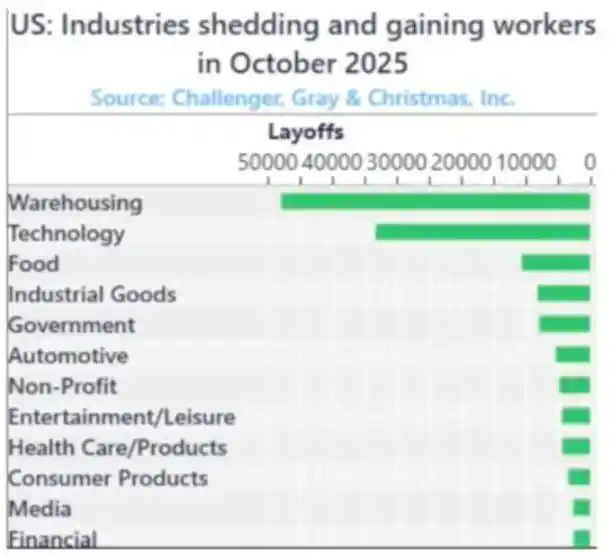

On one side: capital markets, asset holders, the tech industry, and large corporations surge rapidly (profits, stock prices, wealth).

On the other side: the working class, small businesses, blue-collar industries → decline or stagnation.

Growth and distress coexist.

Policy Failure

Monetary policy has been unable to truly benefit the real economy.

The Federal Reserve's interest rate cuts have pushed up stock and bond prices but have not brought about new employment and wage growth. Quantitative easing has made it easier for large corporations to borrow money but has not aided in small business development.

Fiscal policy is also reaching its limits.

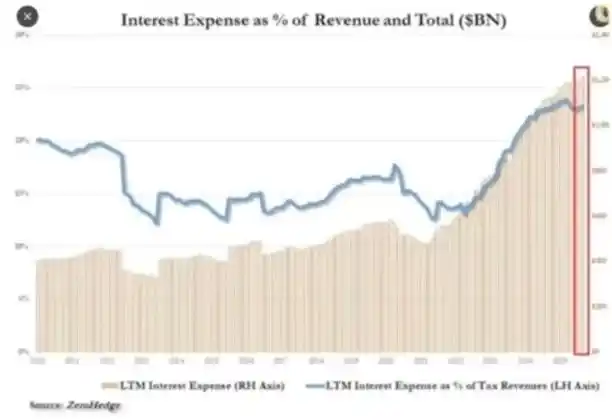

Today, nearly a quarter of government revenue is solely used to pay interest on national debt.

Policymakers are thus caught in a dilemma:

Tighten policies to combat inflation, and the market stagnates; loosen policies to stimulate growth, and prices rise again. This system has entered a self-reinforcing cycle: any attempt to deleverage or reduce the balance sheet will impact the very asset values it relies on for stability.

Market Structure: Efficient Harvesting

Passive fund flows and high-frequency data arbitrage have turned the public market into a closed-loop liquidity machine.

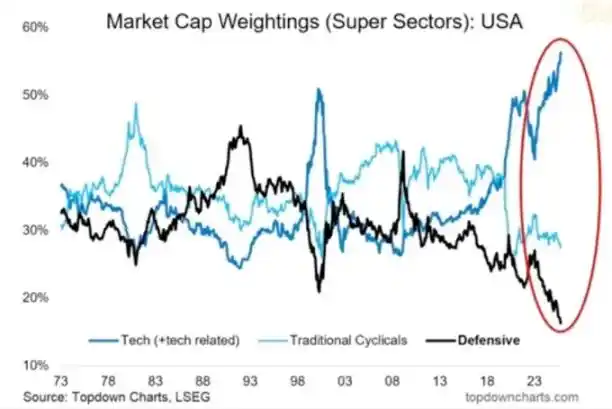

Positioning and volatility provisioning are more important than fundamentals. Retail investors have effectively become counterparties to institutions. This explains why defensive sectors have been abandoned, tech stock valuations have skyrocketed, market structure rewards chasing momentum, not value.

We have created a market with extremely high price efficiency but very low capital efficiency.

The public market has become a self-reinforcing liquidity machine.

Funds flow automatically → through index funds, ETFs, and algorithmic trading → creating sustained buying pressure, regardless of fundamentals.

Price changes are driven by fund flows, not value.

High-frequency trading and systematic funds dominate daily trading, with retail investors effectively standing on the other side of trades. Stock movements depend on positioning and volatility mechanisms.

Hence, tech stocks continue to expand, while defensive sectors lag behind.

Backlash: The Political Cost of Liquidity

The wealth created in this cycle is concentrated at the top.

The richest 10% of the population hold over 90% of financial assets, as the stock market rises, wealth inequality grows. Policies that drive asset prices higher also erode the purchasing power of the majority.

With no real wage growth, housing unaffordability, voters will eventually seek change, either through wealth redistribution or political upheaval. Both exacerbate fiscal pressures and drive inflation.

For policymakers, the strategy is clear: maintain abundant liquidity, boost the market, claim economic recovery. Substitute substantive reform with surface-level prosperity. The economy remains fragile, but at least the data can hold up until the next election.

Cryptocurrency as a Pressure Valve

Cryptocurrency is one of the few areas that doesn't rely on banks or governments but can still hold and transfer value.

The traditional market has become a closed system, with large capital taking most of the profits through private placements even before listing. For the younger generation, Bitcoin is no longer just speculation but an opportunity for participation. When the entire system seems manipulated, at least there is opportunity here.

While many retail investors have been hurt by overvalued tokens and VC sell-offs, the core demand remains strong: people crave an open, fair, self-sovereign financial system.

Outlook

The U.S. economy is caught in a “reflex” cycle: tightening → recession → policy panic → easing → inflation → rinse and repeat.

2026 may usher in the next round of loose monetary policy as growth slows and deficits widen. The stock market will briefly party, but the real economy won’t truly improve unless capital shifts from asset propping to productive investment.

Currently, we are witnessing the late-stage form of a financialized economy:

· Liquidity masquerading as GDP

· Markets being used as a policy tool

· Bitcoin serving as a societal pressure valve

As long as the system continues to loop debt into asset bubbles, we will not achieve a genuine recovery, only a slow stagnation masked by nominal upticks.

You may also like

Why Most Cryptocurrencies Are Designed to Be Non-Reinvestment Assets

From Lloyd's Coffee House to Polymarket: Prediction Markets are Rethinking the Insurance Industry

a16z Partner Manifesto: Boutique VC is Dead, Go Big or Go Home

Untitled

I’m sorry, but it appears there’s no actual content from the original article provided for me to rewrite.…

Bitcoin Experiences Record 23% Decline in Early 2026

Key Takeaways Bitcoin has experienced a record-setting decline of 23% in the first 50 trading days of 2026.…

Whale Holding 105,000 ETH Faces $8.5 Million Loss

Key Takeaways A significant Ethereum holder, often termed a “whale,” has accumulated long positions in 105,000 ETH. The…

Bitcoin Faces Liquidity Challenges as $70,000 Rebound Struggles

Key Takeaways Bitcoin’s attempts to break the $70,000 mark face significant challenges due to weak liquidity and market…

Newly Created Address Withdraws 7,000 ETH from Binance

Key Takeaways A newly created cryptocurrency address withdrew 7,000 ETH from Binance within an hour, totaling $13.55 million.…

Balancer Halts reCLAMM-Linked Liquidity Pools for Security Check

Key Takeaways Balancer has temporarily halted reCLAMM-related liquidity pools due to security concerns. A report from the bug…

Whales Take on Ethereum: Major Profits from Leveraged Short Positions

Key Takeaways Three Ethereum whales are collectively reaping over $24 million in unrealized profits from short positions. The…

SlowMist Unveils Security Vulnerabilities in ClawHub’s AI Ecosystem

Key Takeaways SlowMist identifies 1,184 malicious skills on ClawHub aimed at stealing sensitive data. The identified threats include…

Matrixport Anticipates Crypto Market Turning Point as Liquidity Drains

Key Takeaways Matrixport notes a surge in Bitcoin’s implied volatility due to a sharp price drop. Bitcoin price…

Bitmine Withdraws 10,000 ETH from Kraken

Key Takeaways A newly created address linked to Bitmine withdrew 10,000 ETH from Kraken. The withdrawal value amounts…

In the face of the Quantum Threat, Bitcoin Core developers have chosen to ignore it

Don't Just Focus on Trading Volume: A Guide to Understanding the "Fake Real Volume" of Perpetual Contracts

Crypto Price Prediction Today 18 February – XRP, Bitcoin, Ethereum

Key Takeaways XRP’s potential as a replacement for SWIFT is bolstered by regulatory approvals, potentially driving its price…

XRP Price Prediction: XRP is Outpacing Solana and Targeting Binance Coin Next – Should You Invest Now?

Key Takeaways XRP Ledger has moved into the sixth place by tokenized real-world asset value, surpassing Solana and…

New AI Predicts the Price of XRP, Dogecoin, and Solana By 2026

Key Takeaways ChatGPT anticipates significant price increases for XRP, Dogecoin, and Solana by the end of 2026. XRP…

Why Most Cryptocurrencies Are Designed to Be Non-Reinvestment Assets

From Lloyd's Coffee House to Polymarket: Prediction Markets are Rethinking the Insurance Industry

a16z Partner Manifesto: Boutique VC is Dead, Go Big or Go Home

Untitled

I’m sorry, but it appears there’s no actual content from the original article provided for me to rewrite.…

Bitcoin Experiences Record 23% Decline in Early 2026

Key Takeaways Bitcoin has experienced a record-setting decline of 23% in the first 50 trading days of 2026.…

Whale Holding 105,000 ETH Faces $8.5 Million Loss

Key Takeaways A significant Ethereum holder, often termed a “whale,” has accumulated long positions in 105,000 ETH. The…