A Decade-Old Crypto Veteran, Zcash Is Facing a Midlife Crisis Too

Source: TechFlow (Shenchao)

On January 7, Zcash’s entire core development team resigned.

Not one or two people in a dispute—but the whole Electric Coin Company (ECC), around 25 people in total, including the CEO, walked out together.

ECC is the primary developer behind Zcash. Put simply, the people who write the code quit.

The market reacted immediately. ZEC fell more than 20% on the news.

A quick reminder: Zcash is almost ten years old.

It launched on October 28, 2016—earlier than many people even entered crypto. Its original selling point was “privacy transactions”: sender, receiver, and amount fully encrypted, invisible on-chain.

In reality, after nine years, less than 1% of ZEC transactions actually use the privacy feature

The remaining 99% are effectively transparent.

For nine years, usage stagnated while the team kept going. The price collapsed from over USD 3,000 at launch to around USD 15 in July 2024.

Then, at the end of 2025, ZEC suddenly took off.

From hovering around USD 40 earlier in the year, it surged to USD 744 on November 7, pushing market cap above USD 10 billion and back into the top 20.

The long-dormant “privacy coin” narrative suddenly became fashionable again.

And then—the development team left.

It reads like a midlife script: buy a Porsche, then get divorced. Get the year-end bonus, then break up.

When money is scarce, everyone is a comrade. When money arrives, the fight becomes about who decides.

So what was the fight about?

A wallet called Zashi.

Zashi is a mobile wallet launched by ECC in early 2024, designed with privacy enabled by default. It is the most important user gateway in the Zcash ecosystem.

ECC wanted to privatize Zashi, bring in external capital, and turn it into a venture-backed company that could raise funds and iterate quickly.

But ECC is not an independent for-profit company.

In 2020, ECC was placed under a nonprofit entity called Bootstrap, structured as a U.S. 501(c)(3).

In simple terms: this structure is designed for charities and public-interest organizations. The upside is tax exemption. The downside is that profits cannot be distributed internally, and asset decisions are subject to board approval.

At the time, this was done for compliance—to reduce regulatory pressure from the SEC. In the bear market, nobody cared. There was no money to fight over.

Now, the Bootstrap board said no.

Their reasoning was straightforward: as a nonprofit, they have a legal obligation to protect donor interests. Privatizing Zashi could be illegal, invite lawsuits, or trigger political backlash. They pointed to OpenAI as a cautionary example—how many lawsuits followed its attempt to move from nonprofit to for-profit.

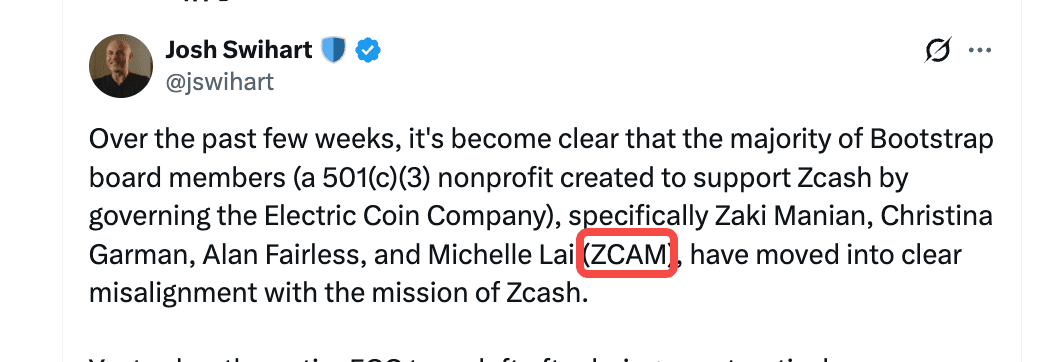

Former ECC CEO Josh Swihart strongly disagreed.

On X, he called the board’s actions “malicious governance behavior”, saying it made it “impossible for the team to perform its duties effectively and with dignity.”

He used a legal term: “constructive discharge”—meaning you’re not formally fired, but working conditions are made untenable, effectively forcing you to leave.

In this case, 25 people were forced out together.

Swihart also publicly named four board members: Zaki, Christina, Alan, and Michelle—and combined their initials into “ZCAM.”

ZCAM.

It sounds a lot like “SCAM.”

Whether intentional or not is unclear.

Among them, Zaki Manian has the most controversial history.

A long-time figure in the Cosmos ecosystem, he was a core member of Tendermint before resigning in 2020 after a public conflict with founder Jae Kwon.

In 2023, the FBI informed him that two developers in a project he oversaw were North Korean agents. He allegedly knew and did not disclose this for 16 months. In October 2024, Jae Kwon publicly accused him of gross negligenceand betraying community trust.

Today, he sits on the Zcash board.

One day after the mass resignation, the former ECC team announced a new company, code-named CashZ.

They said they would use the existing Zashi codebase to launch a new wallet within weeks. Existing Zashi users would be able to migrate seamlessly.

“We are still the same team, with the same mission: to build unstoppable private money.”

No new token. No fork. Just changing the shell and continuing the work.

The most ironic part of this story is the timing.

When ZEC was USD 15, nobody cared who controlled the wallet.

When it hit USD 500, the value of Zashi suddenly became existential.

Money clarifies relationships.

The same nonprofit-versus-startup tension played out very differently elsewhere. At OpenAI, the board lost. At Zcash, the team left.

Who “won” is unclear—but the conflict itself is common across crypto.

On the CashZ website, Swihart wrote why they left:

“The nonprofit foundation model is a relic of crypto’s compliance era. Back then, projects needed a ‘regulatory buffer’ to protect themselves. But those buffers bring bureaucracy and strategic deadlock. Startups can scale quickly. Nonprofits cannot.”

He added:

“Anyone who has spent time in crypto knows this: the entanglement between nonprofit foundations and tech startups is an endless source of drama.”

Endless drama indeed.

In 2023, when Zooko stepped down as CEO, rumors already circulated of disagreements with Swihart. In January 2025, Peter Van Valkenburgh, a board member of the Zcash Foundation, also resigned.

After ten years, most of the original figures are gone.

Someone asked on X: Will Zcash die?

The chain is still running.

The code still exists.

Only the people writing it have changed.

But Swihart is likely right: the tension between nonprofits and startups is a structural flaw in crypto governance. Cosmos fought over it. Ethereum fought over it. Solana fought over it too.

The difference is only in intensity and outcome.

Zcash chose the cleanest option of all.

Break up.

You may also like

WEEX AI Trading Hackathon 2026: How Top AI Strategies Dominated Real Markets

WEEX AI Trading Hackathon demonstrates that effective trading — whether powered by AI or human judgment — relies on core principles: understanding market structure, maintaining conviction, prioritizing quality over quantity, and managing risk intelligently.

WEEX Ai Trading Hackathon vs. Other AI Trading Competitions: Which Is Better for You?

The AI trading competition landscape offers distinct paths for growth. The WEEX AI Trading Hackathon differentiates itself through its focus on real-market execution and practical viability, positioning it as a key platform for aspiring quantitative traders and strategists.

Is AI Trading Replacing Humans? WEEX Hackathon Reveals the Future of Fintech

The WEEX AI Trading Hackathon reveals that the future of trading is not about AI replacing humans, but about collaboration. AI enhances trading capabilities, while human judgment, ethics, and strategic oversight remain essential.

Key Market Information Discrepancy on February 9th - A Must-See! | Alpha Morning Report

"2.5 Dip" Real Reason: Wall Street Deleveraging Induced Overreaction

Kyle's review of Hyperliquid sparks controversy, Solitude Bank officially opens, what are the overseas crypto communities talking about today?

Cryptocurrency prices in the dumps, but the prediction market is going wild?

Decoding Strategy’s Latest Financial Report: After a $12.4 Billion Loss, How Long Can the Bitcoin Flywheel Keep Spinning?

When earnings reports become electrocardiograms of Bitcoin’s price, Strategy is not merely a company—it’s an experiment testing whether faith can overcome gravity.

Discover How to Participate in Staking

Staking is a digital asset yield product launched by the WEEX platform. By subscribing to Staking products, users can stake their idle digital assets and earn corresponding Staking rewards.

WEEX AI Trading Hackathon Rules & Guidelines

This article explains the rules, requirements, and prize structure for the WEEX AI Trading Hackathon Finals, where finalists compete using AI-driven trading strategies under real market conditions.

From 0 to $1 Million: Five Steps to Outperform the Market Through Wallet Tracking

Token Cannot Compound, Where Is the Real Investment Opportunity?

February 6th Market Key Intelligence, How Much Did You Miss?

China's Central Bank and Eight Other Departments' Latest Regulatory Focus: Key Attention to RWA Tokenized Asset Risk

Foreword: Today, the People's Bank of China's website published the "Notice of the People's Bank of China, National Development and Reform Commission, Ministry of Industry and Information Technology, Ministry of Public Security, State Administration for Market Regulation, China Banking and Insurance Regulatory Commission, China Securities Regulatory Commission, State Administration of Foreign Exchange on Further Preventing and Dealing with Risks Related to Virtual Currency and Others (Yinfa [2026] No. 42)", the latest regulatory requirements from the eight departments including the central bank, which are basically consistent with the regulatory requirements of recent years. The main focus of the regulation is on speculative activities such as virtual currency trading, exchanges, ICOs, overseas platform services, and this time, regulatory oversight of RWA has been added, explicitly prohibiting RWA tokenization, stablecoins (especially those pegged to the RMB). The following is the full text:

To the people's governments of all provinces, autonomous regions, and municipalities directly under the Central Government, the Xinjiang Production and Construction Corps:

Recently, there have been speculative activities related to virtual currency and Real-World Assets (RWA) tokenization, disrupting the economic and financial order and jeopardizing the property security of the people. In order to further prevent and address the risks related to virtual currency and Real-World Assets tokenization, effectively safeguard national security and social stability, in accordance with the "Law of the People's Republic of China on the People's Bank of China," "Law of the People's Republic of China on Commercial Banks," "Securities Law of the People's Republic of China," "Law of the People's Republic of China on Securities Investment Funds," "Law of the People's Republic of China on Futures and Derivatives," "Cybersecurity Law of the People's Republic of China," "Regulations of the People's Republic of China on the Administration of Renminbi," "Regulations on Prevention and Disposal of Illegal Fundraising," "Regulations of the People's Republic of China on Foreign Exchange Administration," "Telecommunications Regulations of the People's Republic of China," and other provisions, after reaching consensus with the Cyberspace Administration of China, the Supreme People's Court, and the Supreme People's Procuratorate, and with the approval of the State Council, the relevant matters are notified as follows:

(I) Virtual currency does not possess the legal status equivalent to fiat currency. Virtual currencies such as Bitcoin, Ether, Tether, etc., have the main characteristics of being issued by non-monetary authorities, using encryption technology and distributed ledger or similar technology, existing in digital form, etc. They do not have legal tender status, should not and cannot be circulated and used as currency in the market.

The business activities related to virtual currency are classified as illegal financial activities. The exchange of fiat currency and virtual currency within the territory, exchange of virtual currencies, acting as a central counterparty in buying and selling virtual currencies, providing information intermediary and pricing services for virtual currency transactions, token issuance financing, and trading of virtual currency-related financial products, etc., fall under illegal financial activities, such as suspected illegal issuance of token vouchers, unauthorized public issuance of securities, illegal operation of securities and futures business, illegal fundraising, etc., are strictly prohibited across the board and resolutely banned in accordance with the law. Overseas entities and individuals are not allowed to provide virtual currency-related services to domestic entities in any form.

A stablecoin pegged to a fiat currency indirectly fulfills some functions of the fiat currency in circulation. Without the consent of relevant authorities in accordance with the law and regulations, any domestic or foreign entity or individual is not allowed to issue a RMB-pegged stablecoin overseas.

(II)Tokenization of Real-World Assets refers to the use of encryption technology and distributed ledger or similar technologies to transform ownership rights, income rights, etc., of assets into tokens (tokens) or other interests or bond certificates with token (token) characteristics, and carry out issuance and trading activities.

Engaging in the tokenization of real-world assets domestically, as well as providing related intermediary, information technology services, etc., which are suspected of illegal issuance of token vouchers, unauthorized public offering of securities, illegal operation of securities and futures business, illegal fundraising, and other illegal financial activities, shall be prohibited; except for relevant business activities carried out with the approval of the competent authorities in accordance with the law and regulations and relying on specific financial infrastructures. Overseas entities and individuals are not allowed to illegally provide services related to the tokenization of real-world assets to domestic entities in any form.

(III) Inter-agency Coordination. The People's Bank of China, together with the National Development and Reform Commission, the Ministry of Industry and Information Technology, the Ministry of Public Security, the State Administration for Market Regulation, the China Banking and Insurance Regulatory Commission, the China Securities Regulatory Commission, the State Administration of Foreign Exchange, and other departments, will improve the work mechanism, strengthen coordination with the Cyberspace Administration of China, the Supreme People's Court, and the Supreme People's Procuratorate, coordinate efforts, and overall guide regions to carry out risk prevention and disposal of virtual currency-related illegal financial activities.

The China Securities Regulatory Commission, together with the National Development and Reform Commission, the Ministry of Industry and Information Technology, the Ministry of Public Security, the People's Bank of China, the State Administration for Market Regulation, the China Banking and Insurance Regulatory Commission, the State Administration of Foreign Exchange, and other departments, will improve the work mechanism, strengthen coordination with the Cyberspace Administration of China, the Supreme People's Court, and the Supreme People's Procuratorate, coordinate efforts, and overall guide regions to carry out risk prevention and disposal of illegal financial activities related to the tokenization of real-world assets.

(IV) Strengthening Local Implementation. The people's governments at the provincial level are overall responsible for the prevention and disposal of risks related to virtual currencies and the tokenization of real-world assets in their respective administrative regions. The specific leading department is the local financial regulatory department, with participation from branches and dispatched institutions of the State Council's financial regulatory department, telecommunications regulators, public security, market supervision, and other departments, in coordination with cyberspace departments, courts, and procuratorates, to improve the normalization of the work mechanism, effectively connect with the relevant work mechanisms of central departments, form a cooperative and coordinated working pattern between central and local governments, effectively prevent and properly handle risks related to virtual currencies and the tokenization of real-world assets, and maintain economic and financial order and social stability.

(5) Enhanced Risk Monitoring. The People's Bank of China, China Securities Regulatory Commission, National Development and Reform Commission, Ministry of Industry and Information Technology, Ministry of Public Security, State Administration of Foreign Exchange, Cyberspace Administration of China, and other departments continue to improve monitoring techniques and system support, enhance cross-departmental data analysis and sharing, establish sound information sharing and cross-validation mechanisms, promptly grasp the risk situation of activities related to virtual currency and real-world asset tokenization. Local governments at all levels give full play to the role of local monitoring and early warning mechanisms. Local financial regulatory authorities, together with branches and agencies of the State Council's financial regulatory authorities, as well as departments of cyberspace and public security, ensure effective connection between online monitoring, offline investigation, and fund tracking, efficiently and accurately identify activities related to virtual currency and real-world asset tokenization, promptly share risk information, improve early warning information dissemination, verification, and rapid response mechanisms.

(6) Strengthened Oversight of Financial Institutions, Intermediaries, and Technology Service Providers. Financial institutions (including non-bank payment institutions) are prohibited from providing account opening, fund transfer, and clearing services for virtual currency-related business activities, issuing and selling financial products related to virtual currency, including virtual currency and related financial products in the scope of collateral, conducting insurance business related to virtual currency, or including virtual currency in the scope of insurance liability. Financial institutions (including non-bank payment institutions) are prohibited from providing custody, clearing, and settlement services for unauthorized real-world asset tokenization-related business and related financial products. Relevant intermediary institutions and information technology service providers are prohibited from providing intermediary, technical, or other services for unauthorized real-world asset tokenization-related businesses and related financial products.

(7) Enhanced Management of Internet Information Content and Access. Internet enterprises are prohibited from providing online business venues, commercial displays, marketing, advertising, or paid traffic diversion services for virtual currency and real-world asset tokenization-related business activities. Upon discovering clues of illegal activities, they should promptly report to relevant departments and provide technical support and assistance for related investigations and inquiries. Based on the clues transferred by the financial regulatory authorities, the cyberspace administration, telecommunications authorities, and public security departments should promptly close and deal with websites, mobile applications (including mini-programs), and public accounts engaged in virtual currency and real-world asset tokenization-related business activities in accordance with the law.

(8) Strengthened Entity Registration and Advertisement Management. Market supervision departments strengthen entity registration and management, and enterprise and individual business registrations must not contain terms such as "virtual currency," "virtual asset," "cryptocurrency," "crypto asset," "stablecoin," "real-world asset tokenization," or "RWA" in their names or business scopes. Market supervision departments, together with financial regulatory authorities, legally enhance the supervision of advertisements related to virtual currency and real-world asset tokenization, promptly investigating and handling relevant illegal advertisements.

(IX) Continued Rectification of Virtual Currency Mining Activities. The National Development and Reform Commission, together with relevant departments, strictly controls virtual currency mining activities, continuously promotes the rectification of virtual currency mining activities. The people's governments of various provinces take overall responsibility for the rectification of "mining" within their respective administrative regions. In accordance with the requirements of the National Development and Reform Commission and other departments in the "Notice on the Rectification of Virtual Currency Mining Activities" (NDRC Energy-saving Building [2021] No. 1283) and the provisions of the "Guidance Catalog for Industrial Structure Adjustment (2024 Edition)," a comprehensive review, investigation, and closure of existing virtual currency mining projects are conducted, new mining projects are strictly prohibited, and mining machine production enterprises are strictly prohibited from providing mining machine sales and other services within the country.

(X) Severe Crackdown on Related Illegal Financial Activities. Upon discovering clues to illegal financial activities related to virtual currency and the tokenization of real-world assets, local financial regulatory authorities, branches of the State Council's financial regulatory authorities, and other relevant departments promptly investigate, determine, and properly handle the issues in accordance with the law, and seriously hold the relevant entities and individuals legally responsible. Those suspected of crimes are transferred to the judicial authorities for processing according to the law.

(XI) Severe Crackdown on Related Illegal and Criminal Activities. The Ministry of Public Security, the People's Bank of China, the State Administration for Market Regulation, the China Banking and Insurance Regulatory Commission, the China Securities Regulatory Commission, as well as judicial and procuratorial organs, in accordance with their respective responsibilities, rigorously crack down on illegal and criminal activities related to virtual currency, the tokenization of real-world assets, such as fraud, money laundering, illegal business operations, pyramid schemes, illegal fundraising, and other illegal and criminal activities carried out under the guise of virtual currency, the tokenization of real-world assets, etc.

(XII) Strengthen Industry Self-discipline. Relevant industry associations should enhance membership management and policy advocacy, based on their own responsibilities, advocate and urge member units to resist illegal financial activities related to virtual currency and the tokenization of real-world assets. Member units that violate regulatory policies and industry self-discipline rules are to be disciplined in accordance with relevant self-regulatory management regulations. By leveraging various industry infrastructure, conduct risk monitoring related to virtual currency, the tokenization of real-world assets, and promptly transfer issue clues to relevant departments.

(XIII) Without the approval of relevant departments in accordance with the law and regulations, domestic entities and foreign entities controlled by them may not issue virtual currency overseas.

(XIV) Domestic entities engaging directly or indirectly in overseas external debt-based tokenization of real-world assets, or conducting asset securitization activities abroad based on domestic ownership rights, income rights, etc. (hereinafter referred to as domestic equity), should be strictly regulated in accordance with the principles of "same business, same risk, same rules." The National Development and Reform Commission, the China Securities Regulatory Commission, the State Administration of Foreign Exchange, and other relevant departments regulate it according to their respective responsibilities. For other forms of overseas real-world asset tokenization activities based on domestic equity by domestic entities, the China Securities Regulatory Commission, together with relevant departments, supervise according to their division of responsibilities. Without the consent and filing of relevant departments, no unit or individual may engage in the above-mentioned business.

(15) Overseas subsidiaries and branches of domestic financial institutions providing Real World Asset Tokenization-related services overseas shall do so legally and prudently. They shall have professional personnel and systems in place to effectively mitigate business risks, strictly implement customer onboarding, suitability management, anti-money laundering requirements, and incorporate them into the domestic financial institutions' compliance and risk management system. Intermediaries and information technology service providers offering Real World Asset Tokenization services abroad based on domestic equity or conducting Real World Asset Tokenization business in the form of overseas debt for domestic entities directly or indirectly venturing abroad must strictly comply with relevant laws and regulations. They should establish and improve relevant compliance and internal control systems in accordance with relevant normative requirements, strengthen business and risk control, and report the business developments to the relevant regulatory authorities for approval or filing.

(16) Strengthen organizational leadership and overall coordination. All departments and regions should attach great importance to the prevention of risks related to virtual currencies and Real World Asset Tokenization, strengthen organizational leadership, clarify work responsibilities, form a long-term effective working mechanism with centralized coordination, local implementation, and shared responsibilities, maintain high pressure, dynamically monitor risks, effectively prevent and mitigate risks in an orderly and efficient manner, legally protect the property security of the people, and make every effort to maintain economic and financial order and social stability.

(17) Widely carry out publicity and education. All departments, regions, and industry associations should make full use of various media and other communication channels to disseminate information through legal and policy interpretation, analysis of typical cases, and education on investment risks, etc. They should promote the illegality and harm of virtual currencies and Real World Asset Tokenization-related businesses and their manifestations, fully alert to potential risks and hidden dangers, and enhance public awareness and identification capabilities for risk prevention.

(18) Engaging in illegal financial activities related to virtual currencies and Real World Asset Tokenization in violation of this notice, as well as providing services for virtual currencies and Real World Asset Tokenization-related businesses, shall be punished in accordance with relevant regulations. If it constitutes a crime, criminal liability shall be pursued according to the law. For domestic entities and individuals who knowingly or should have known that overseas entities illegally provided virtual currency or Real World Asset Tokenization-related services to domestic entities and still assisted them, relevant responsibilities shall be pursued according to the law. If it constitutes a crime, criminal liability shall be pursued according to the law.

(19) If any unit or individual invests in virtual currencies, Real World Asset Tokens, and related financial products against public order and good customs, the relevant civil legal actions shall be invalid, and any resulting losses shall be borne by them. If there are suspicions of disrupting financial order and jeopardizing financial security, the relevant departments shall deal with them according to the law.

This notice shall enter into force upon the date of its issuance. The People's Bank of China and ten other departments' "Notice on Further Preventing and Dealing with the Risks of Virtual Currency Trading Speculation" (Yinfa [2021] No. 237) is hereby repealed.

Former Partner's Perspective on Multicoin: Kyle's Exit, But the Game He Left Behind Just Getting Started

Why Bitcoin Is Falling Now: The Real Reasons Behind BTC's Crash & WEEX's Smart Profit Playbook

Bitcoin's ongoing crash explained: Discover the 5 hidden triggers behind BTC's plunge & how WEEX's Auto Earn and Trade to Earn strategies help traders profit from crypto market volatility.

Wall Street's Hottest Trades See Exodus

Vitalik Discusses Ethereum Scaling Path, Circle Announces Partnership with Polymarket, What's the Overseas Crypto Community Talking About Today?

WEEX AI Trading Hackathon 2026: How Top AI Strategies Dominated Real Markets

WEEX AI Trading Hackathon demonstrates that effective trading — whether powered by AI or human judgment — relies on core principles: understanding market structure, maintaining conviction, prioritizing quality over quantity, and managing risk intelligently.

WEEX Ai Trading Hackathon vs. Other AI Trading Competitions: Which Is Better for You?

The AI trading competition landscape offers distinct paths for growth. The WEEX AI Trading Hackathon differentiates itself through its focus on real-market execution and practical viability, positioning it as a key platform for aspiring quantitative traders and strategists.

Is AI Trading Replacing Humans? WEEX Hackathon Reveals the Future of Fintech

The WEEX AI Trading Hackathon reveals that the future of trading is not about AI replacing humans, but about collaboration. AI enhances trading capabilities, while human judgment, ethics, and strategic oversight remain essential.

Earn

Earn